Details

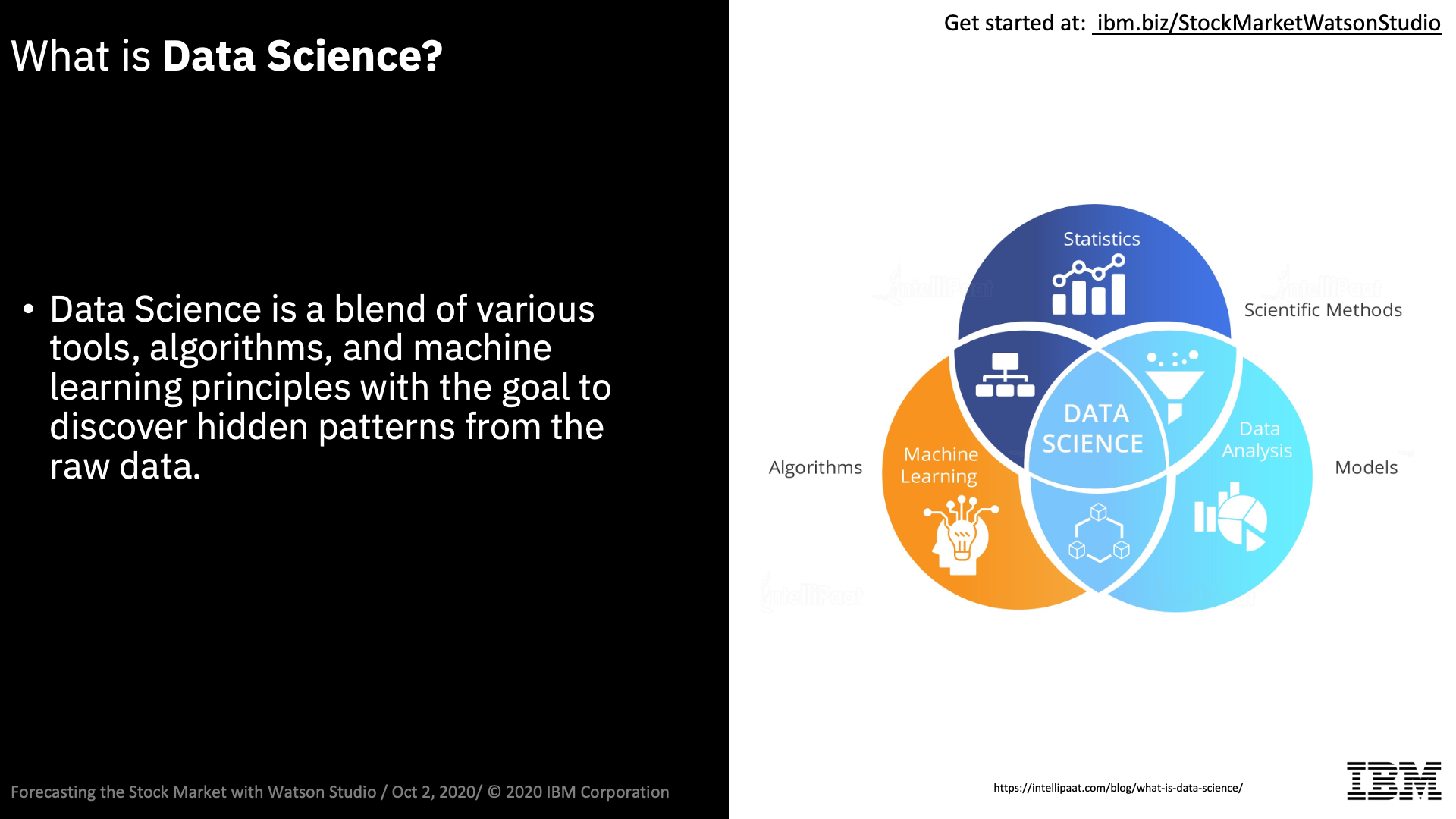

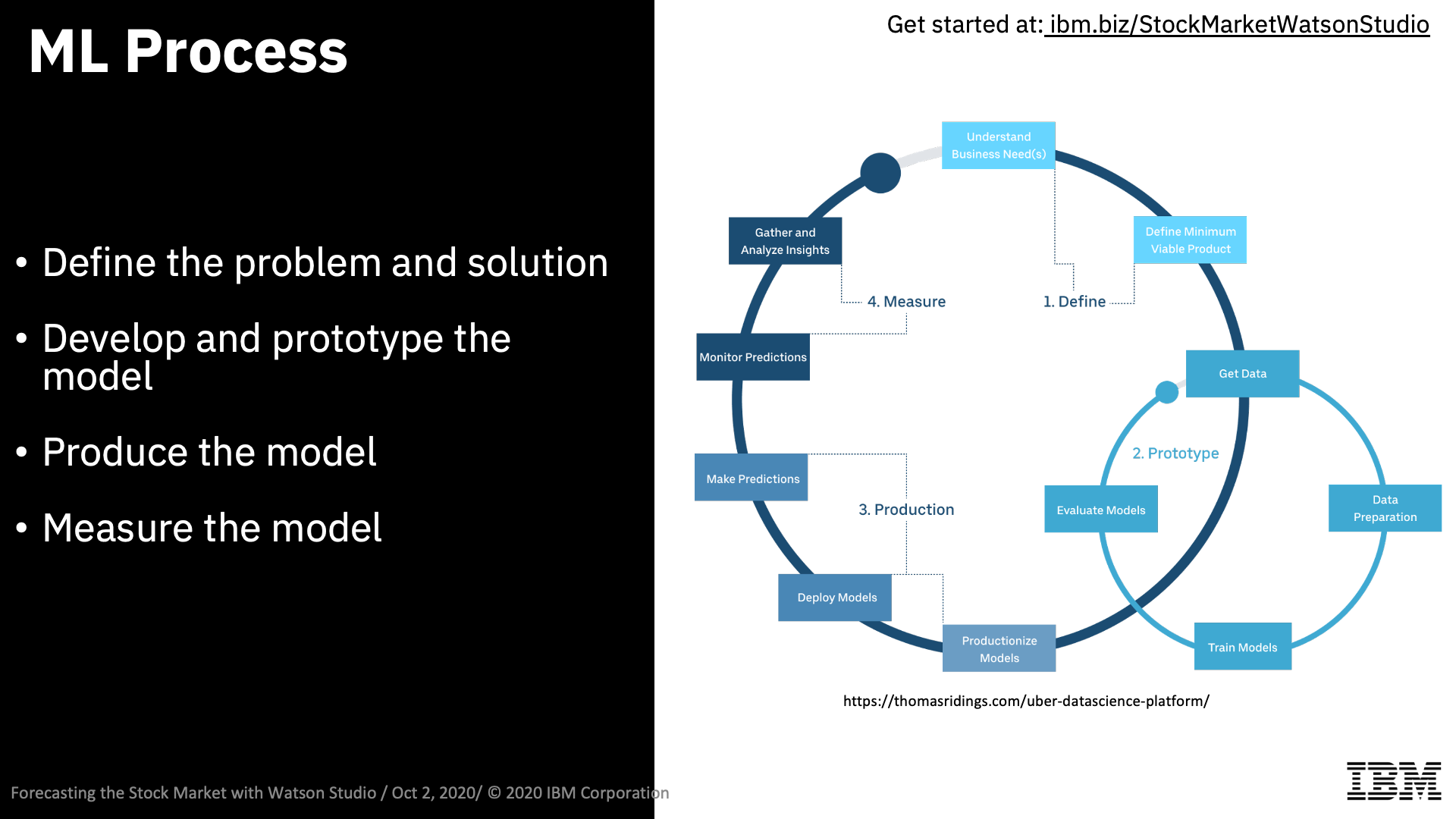

Using IBM Watson Studio and Watson Machine Learning, this code pattern provides an example of data science workflow which attempts to predict the end-of-day value of S&P 500 stocks based on historical data. This pattern includes the data mining process that uses the Quandl API – a marketplace for financial, economic, and alternative data delivered in modern formats for today’s analysts.

🎓 Learning outcomes

- Use Jupyter Notebooks in Watson Studio to mine financial data using public APIs.

- Use specialized Watson Studio tools like Data Refinery to prepare data for model training.

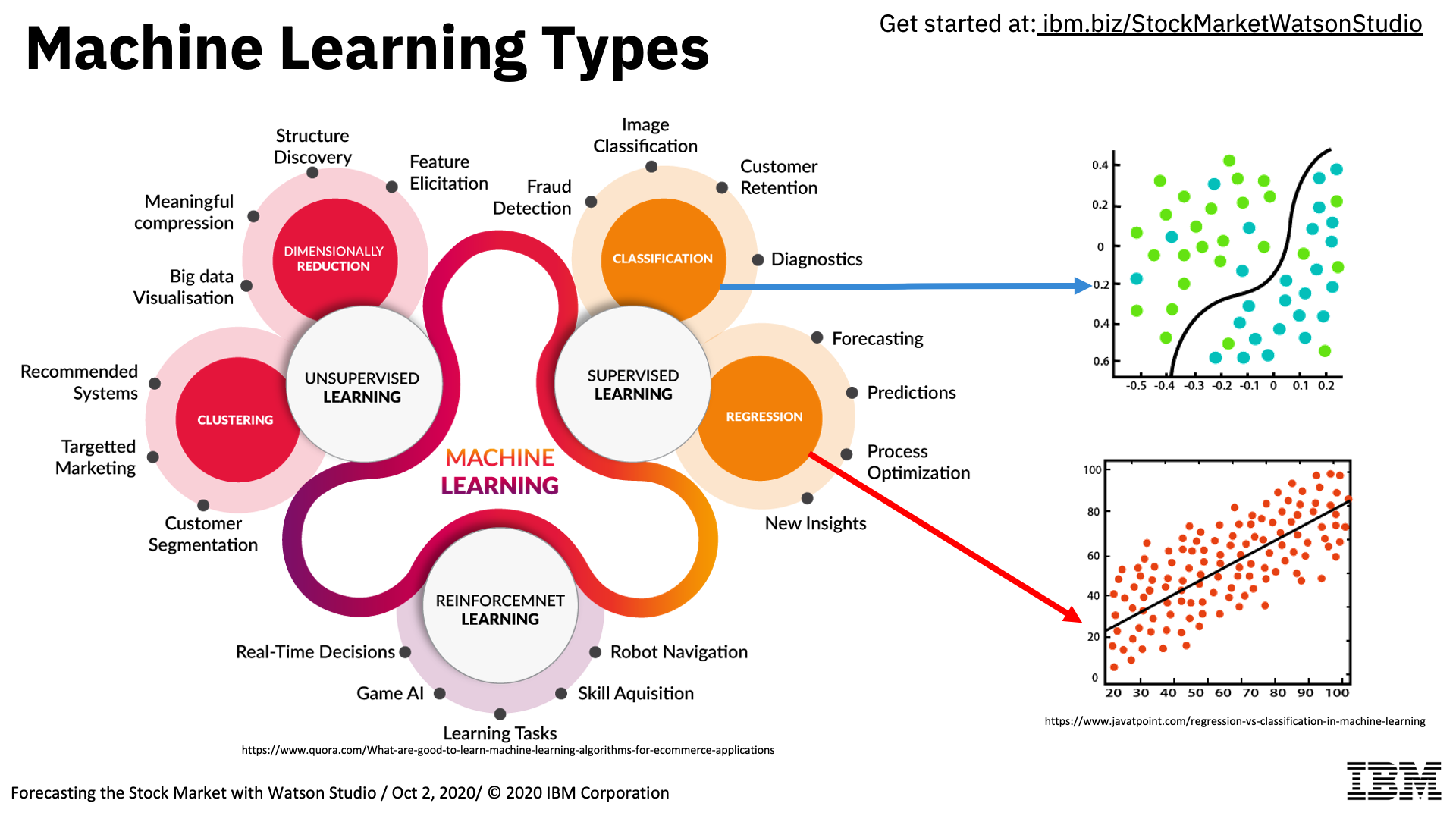

- Build, train, and save a time series model from extracted data, using open-source Python libraries or the built-in graphical -Modeler Flow in Watson Studio.

- Interact with IBM Cloud Object Storage to store and access mined and modeled data.

- Store a model created with Modeler Flow and interact with the Watson Machine Learning service using the Python API.

- Generate graphical visualizations of time series data using Pandas and Bokeh.

🎙Speakers

- Mridul Bhandari, IBM Developer Advocate, https://developer.ibm.com/profiles/mridul.bhandari/

- Anchal Bhalla, Data and AI Technical Specialist, https://developer.ibm.com/profiles/anchal.bhalla/

🎈Prerequisites

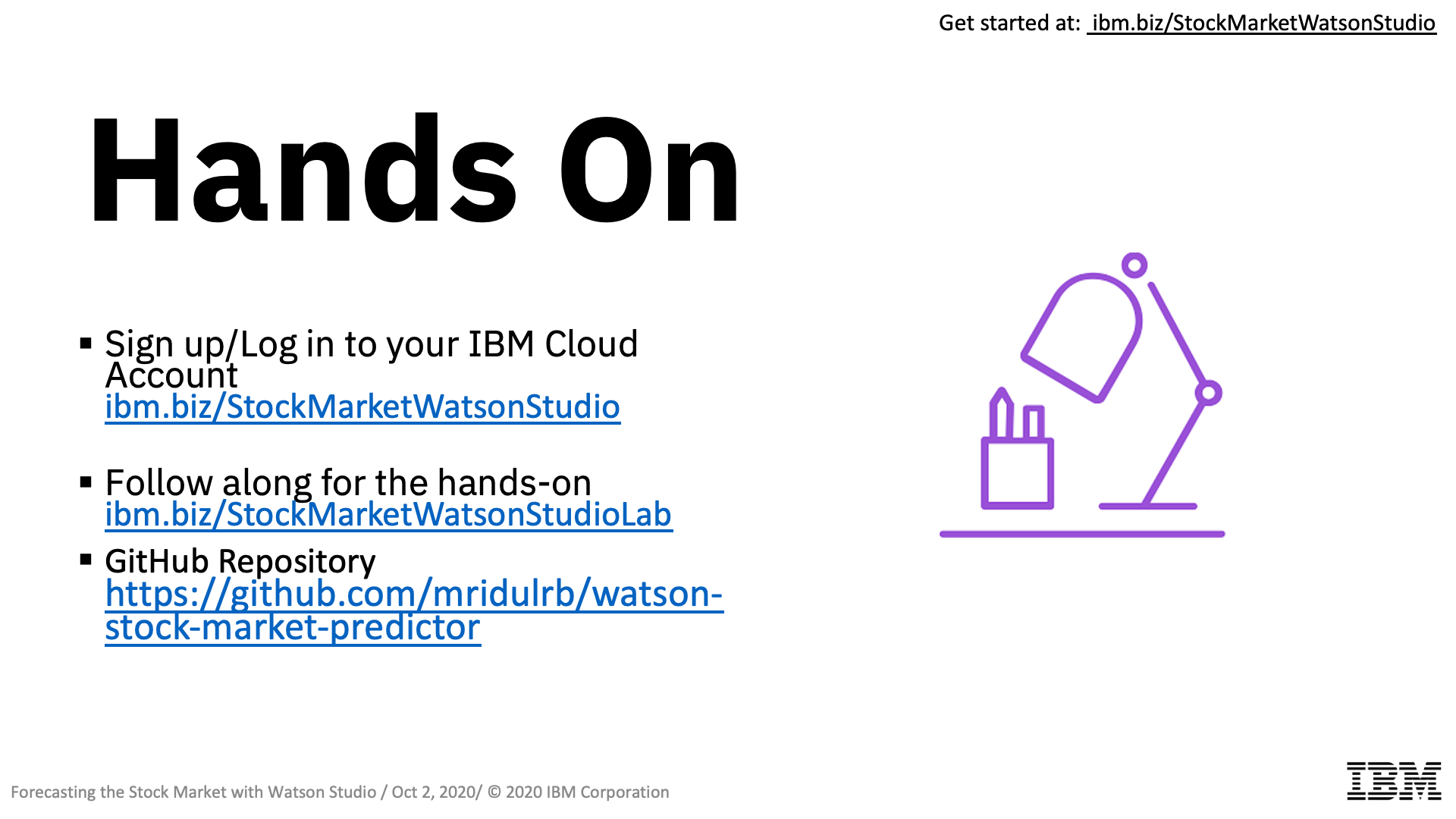

- IBM Cloud Sign-up link - http://ibm.biz/StockMarketWatsonStudio

- Register for the live event or watch the recording: https://www.crowdcast.io/e/forecast-stock-market

👩💻Resources

- Hands-on - https://ibm.biz/StockMarketWatsonStudioLab

- GitHub Repository - https://github.com/IBM/watson-stock-market-predictor

- Survey - https://www.surveymonkey.com/r/JHT3L8Y

- Meetup page: https://www.meetup.com/IBM-Cloud-MEA/events/